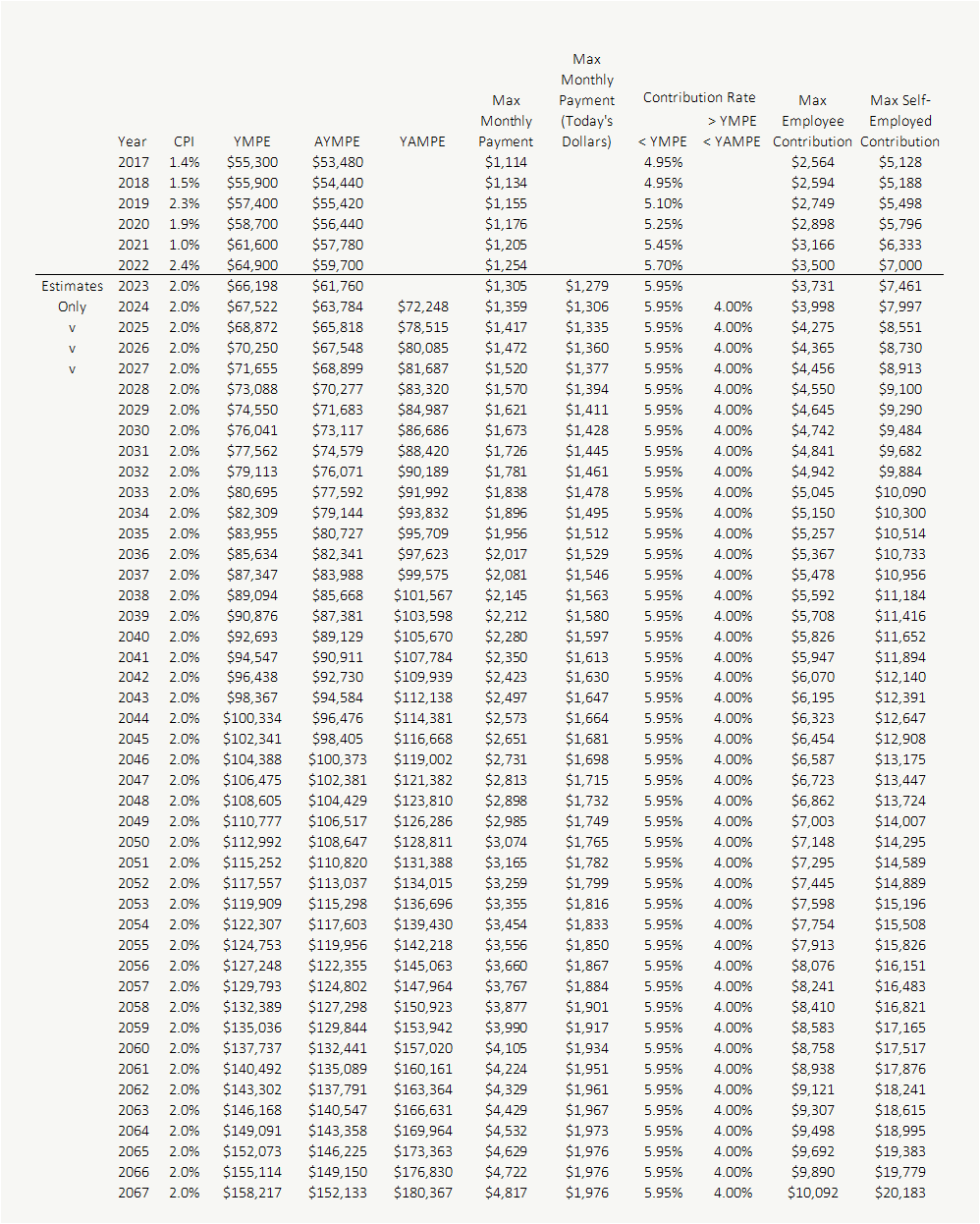

Cpp Max Canada 2025. Starting in 2025, the canada pension plan (cpp) introduces a second earnings ceiling, with the maximum pensionable earnings set at $68,500, up from. What is the maximum cpp benefit i can receive in 2025?

Here’s a graph of the cpp maximums for the 8 years since the liberal government has been in power:. The maximum employer and employee contribution to the cpp for 2025 will be $3,867.50 each, up from $3,754.45 in 2025.

For 2025, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2025 was.

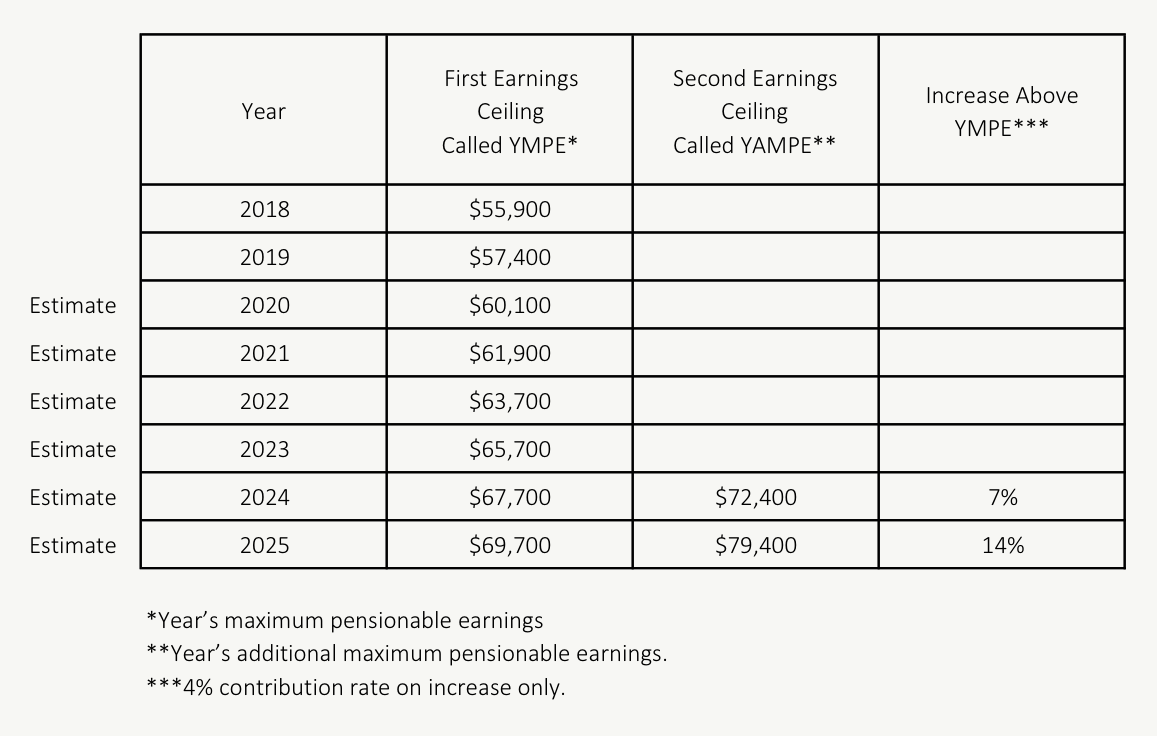

CPP Max 2025 Understanding Canada Pension Plan Contribution Rates, The basic exemption amount for 2025 remains at $3,500. The basic exemption amount for 2025.

Canada Pension Plan Payment Dates How Much CPP Will You Get This Year, Starting in 2025, the canada pension plan (cpp) introduces a second earnings ceiling, with the maximum pensionable earnings set at $68,500, up from. Under the canada pension plan in 2025, canadians can contribute up to a year’s maximum pensionable earnings (ympe) of $68,500.

A Complete Guide to the Canada Pension Plan, The average cpp disability benefit for 2025 is between $1,170 and $1,606 monthly. The maximum employer and employee contribution to the cpp for 2025 will be $3,867.50 each, up from $3,754.45 in 2025.

CPP Payment Dates Jan. 2025 Canada Pension Plan Guide, How much extra will i get from cpp each month in 2025? Remax’s canada cottage cabin trends report projects that recreational property prices will increase by 6.8 per cent in 2025, with the majority of canadian.

Canada Pension Plan (CPP) Is Expanding! And That’s Going To Make, The maximum pensionable earnings under the canada pension plan (cpp) will be $68 ,500—up from $66,600 in 2025. The maximum employer and employee contribution to the cpp for 2025 will be $3,867.50 each, up from $3,754.45 in 2025.

The CPP Max Will Be HUGE In 2025 Canada, The basic exemption amount for 2025 remains at $3,500. Employee and employer cpp contribution rates for 2025 remain at 5.95%, and the maximum.

CPP Payment Dates 2025 Canada Pension Plan Dates Updated, Overall, people earning over $73,200 will be contributing an extra $300 in 2025, compared to their. For 2025, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2025 was.

The CPP Max Will Be HUGE In The Future PlanEasy, For 2025, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2025 was. The amount depends on your earnings and.

How to apply for canada pension from usa Fill out & sign online DocHub, The maximum pensionable earnings under the canada pension plan (cpp) will be $68 ,500—up from $66,600 in 2025. 2025 cpp rates for employers and employees in canada.

CPP Max 2025 Complete Analysis on What will be the Max CPP, The cpp earnings exemption has been $3,500 over the past two decades, while the maximum pensionable earnings increase yearly in line with canada’s. The average cpp disability benefit for 2025 is between $1,170 and $1,606 monthly.

Starting in 2025, the canada pension plan (cpp) introduces a second earnings ceiling, with the maximum pensionable earnings set at $68,500, up from.